It can be one of the toughest calculations to make in adulthood—when to transition from being a renter to a homeowner. Some do it the moment they can afford it, perhaps committing to a fixer upper or delighting in a new construction home. For others, the decision and timing are more complex, often taking into account factors like career, relationships and market conditions. And, of course, a small but not insignificant number of people simply believe renting just makes more sense.

In any case, making the right decision at the right time requires a lot of knowledge. We recently surveyed 1,071 millennials to understand both their attitudes towards homeownership and to test how well they understand the process.

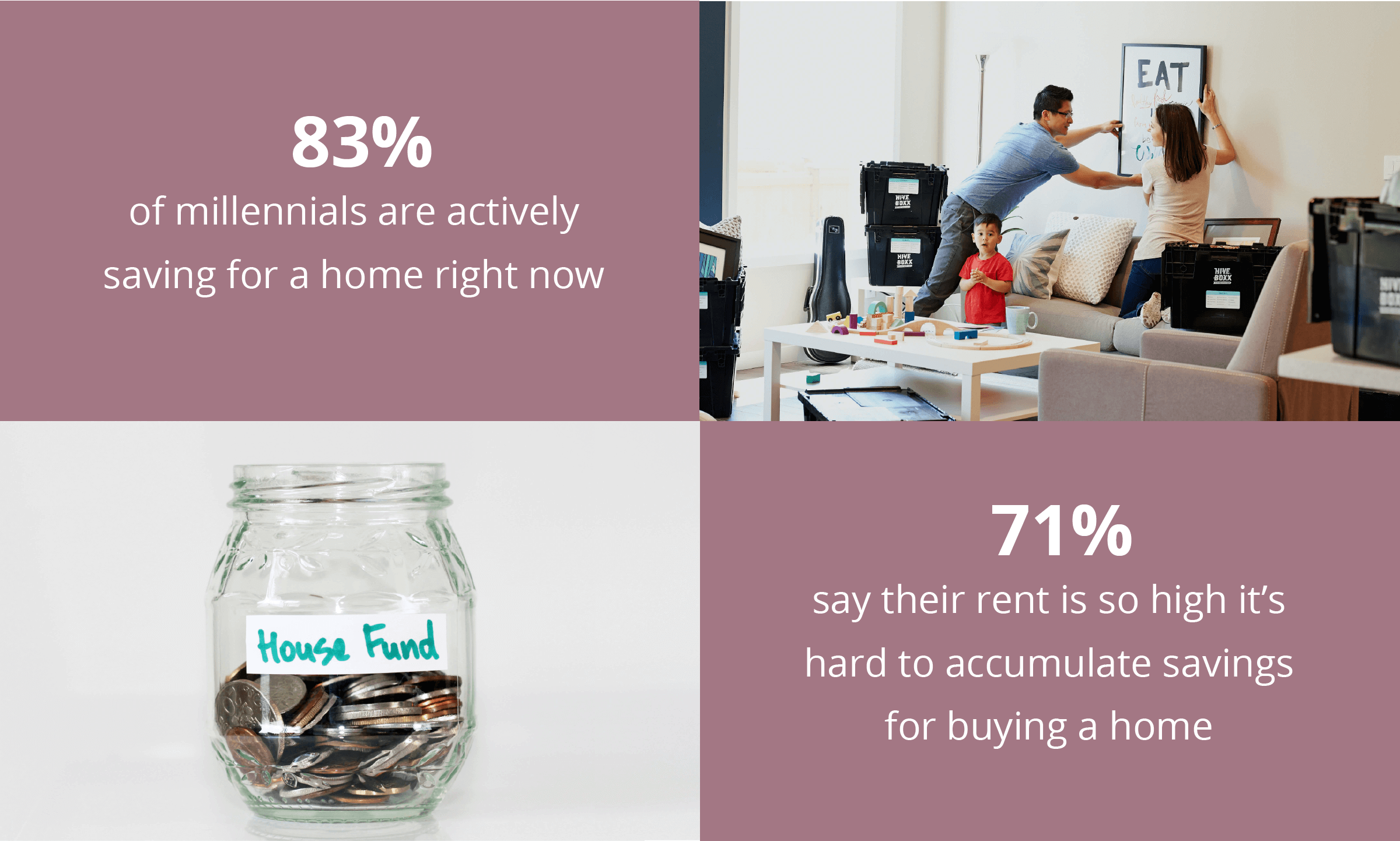

To begin, we asked about saving for the costs of homeownership. Eighty-three percent of millennials say they are actively saving right now, though many of them (71 percent) say their rent is so high it’s very difficult to accumulate much in savings. Debt also inhibits savings for many: 51 percent of millennials have credit card debt, 39 percent have student loans, 29 percent have auto loans and 17 percent have medical debt.

Two in three millennials (66 percent) say they are waiting for lower mortgage rates to start the home buying process. This is odd given the fact that rates are currently near historic lows, but it may speak to a lack of education and awareness among this cohort of home buyers. More on that soon.

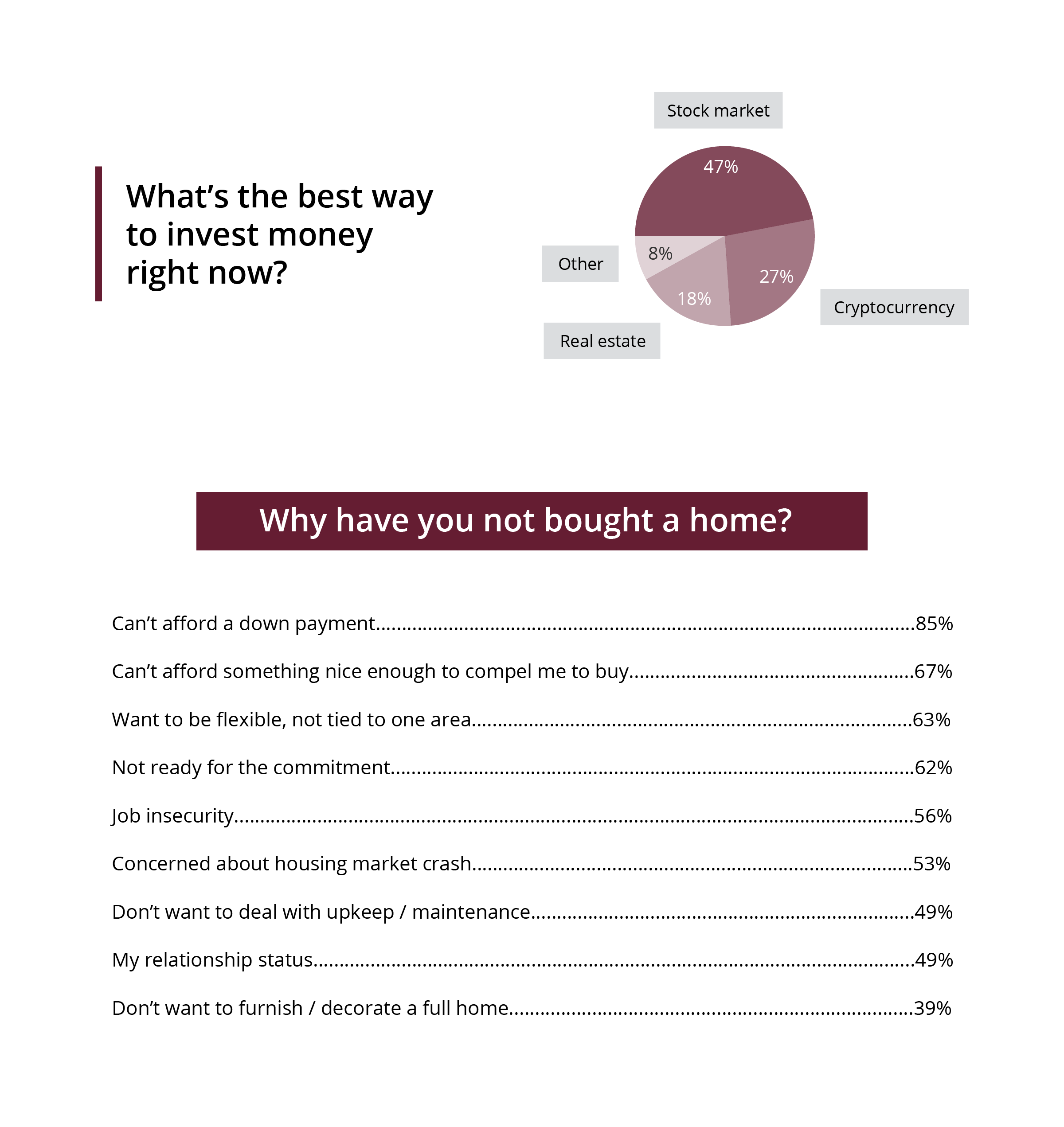

We asked non-homeowners a series of questions to understand why they’re still renting. Again, it’s not always an issue of money. Many interesting perspectives emerged from these queries.

For one, most millennials don’t see real estate as the most attractive way to invest money. Twice as many millennials prefer the stock market for investing over real estate. In fact, more millennials even prefer cryptocurrency (24 percent) over real estate (22 percent), as far as investment opportunities go.

Among the other reasons holding millennials back: fear of commitment to one area (63 percent), job insecurity (56 percent), and concerns about a housing market crash (53 percent).

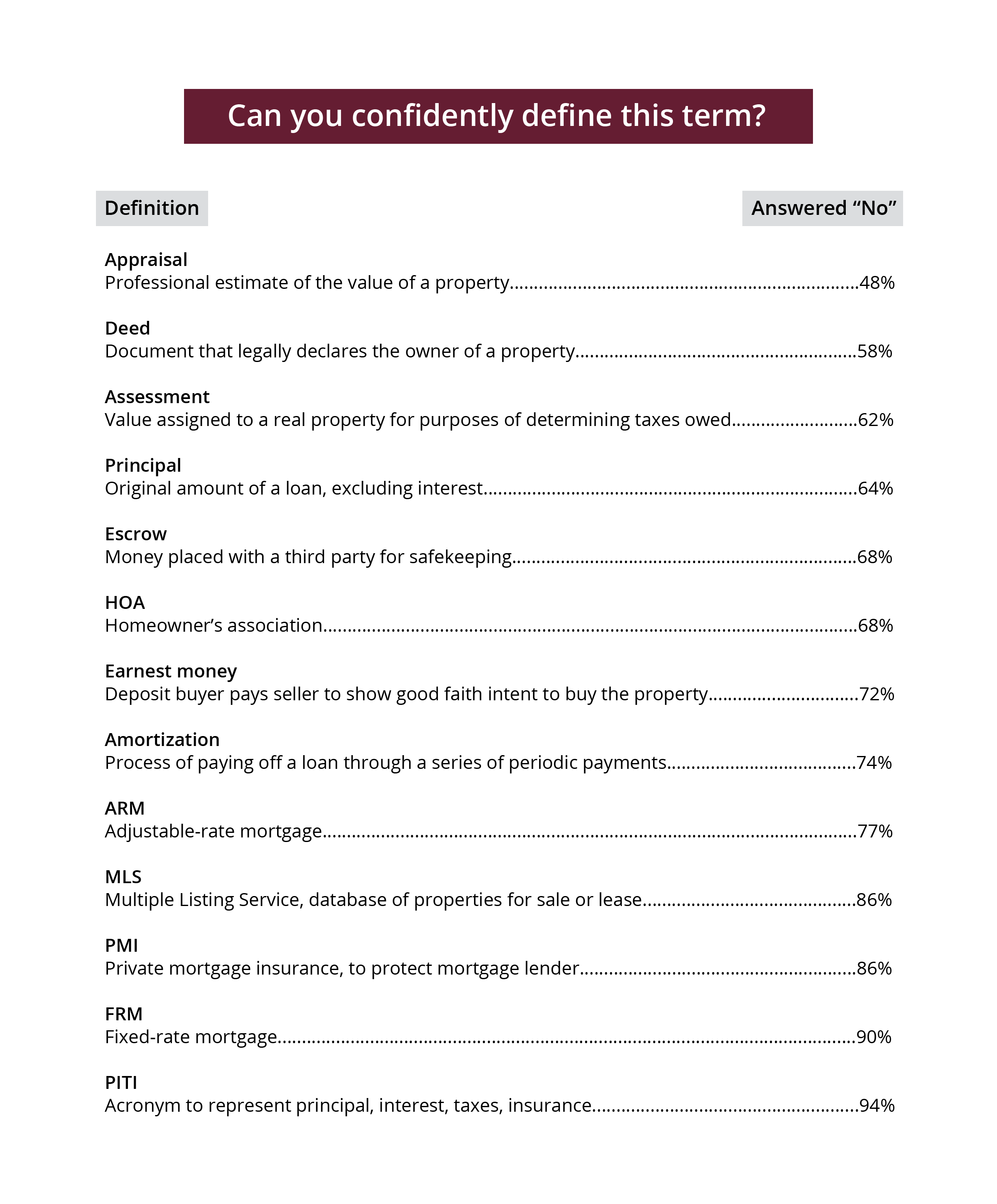

When we started asking questions about specifics of the home buying process, it became clear that millennials are undereducated on the subject. It’s certainly to be expected that people have a lot to learn going through the process for the first time, but across all of our questions, there was a general lack of awareness of what’s needed upfront to buy a home, and what the financial implications of long-term homeownership are.

We began by asking if people can define common terms that home buyers will encounter when navigating the home buying process.

When asked about the upfront costs and long-term financial implications of homeownership, underestimation was the trend. Millennials underestimated how much home they can afford right now, underestimated how much interest they would pay over a 30-year mortgage, and underestimated how much home values appreciate over ten years, on average.

Was there anything millennials nailed when quizzed about homeownership? Yes, a few things. In the US, average closing fees amount to two to five percent of the home price, and the average estimate from our respondents was five percent. We also asked what percentage a home’s value increases each year, on average. The answer is four percent and that was the most common response in our survey. Finally, we asked if there’s a general rule for what percentage of one’s income should be spent on either rent or mortgage. That general rule says 30 percent and millennials were spot-on—the most common answer was 25 to 30 percent. Hey, it’s a start!

Between April 16 – 21, 2021, we surveyed 1,071 non-homeowner millennials (between the ages of 25 and 40 years old) about their attitudes towards homeownership and their understanding of the home buying process. Our respondents were 46 percent female and 54 percent male, with an average age of 31 years old.

For media inquiries, contact [email protected]

Feel free to use this data and research with proper attribution linking to this study. When you do, please give credit and link to https://lombardohomes.com/