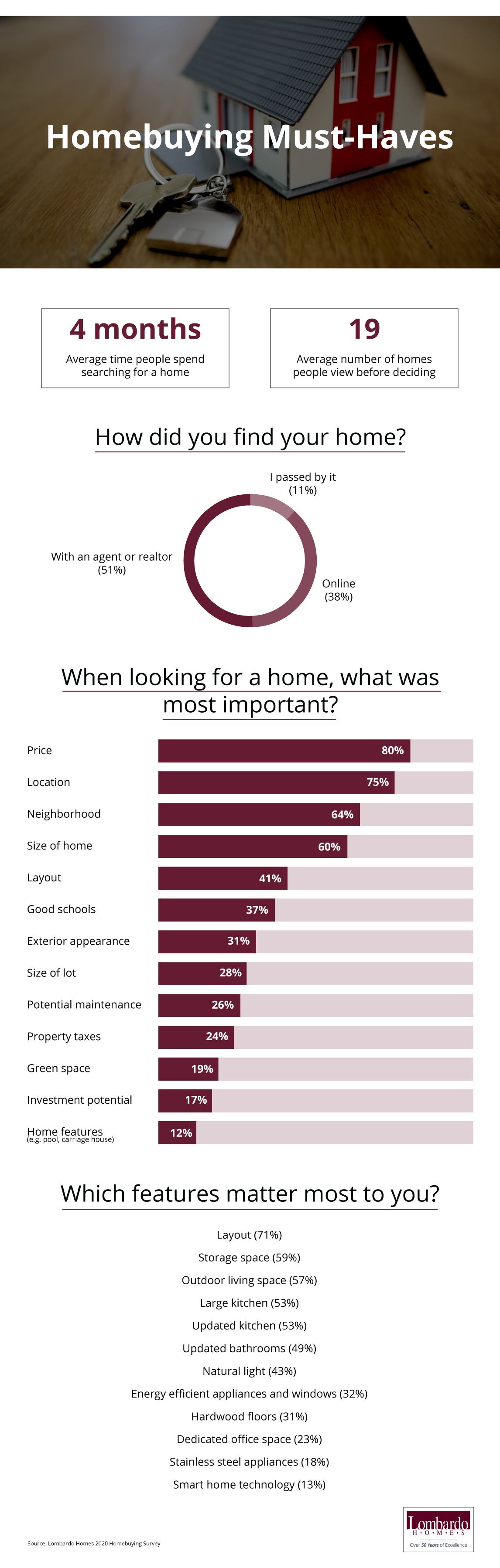

Whether you’re looking for a fixer upper or custom new construction, buying a home is one of the most meaningful investments a person can make, and it’s no surprise how much thought and time goes into the process. With the average home search spanning 19 properties over the course of four months, it’s clear that buyers are willing to work.

Half of all buyers rely on the help of an agent or realtor to find the perfect home, while two in three now turn to online sources such as Redfin or Zillow. Options seem virtually endless, but most buyers say they simply want a home with three bedrooms and two bathrooms, at a reasonable price, in a good neighborhood. But before putting in an offer, there’s a lot to consider, certainly beyond physical appearance. Factors like interior appliances, renovations and school system ratings all weigh heavily in the decision-making process.

What matters most to today’s home buyers? We surveyed 1,794 current homeowners to find out.

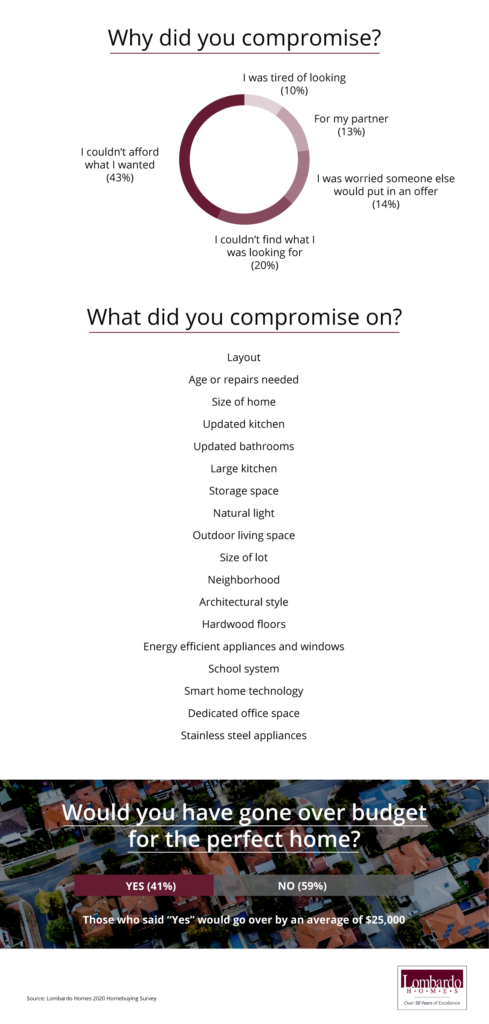

It’s not always easy to find a dream home. When asked, one in three respondents said they compromised on at least one aspect of their home, most often because of budget. The top compromises? Layout (29%), the age of the home or repairs needed (29%), the size of the home (26%), an updated kitchen (23%), and updated bathrooms (19%).

While women were more likely to say they compromised than their partners, neither gender wanted to compromise on the architectural style of the home, the neighborhood, or the local school system.

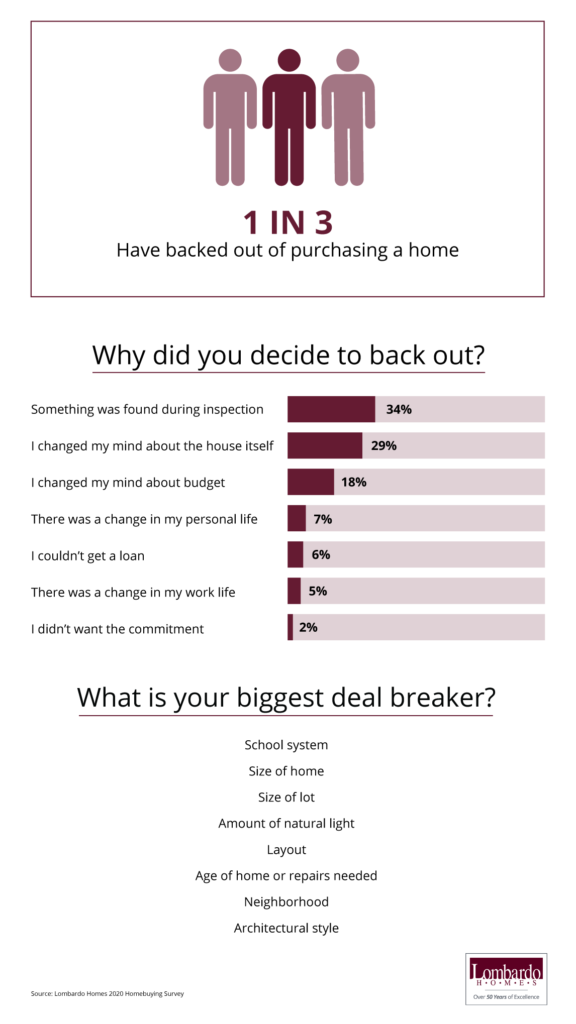

When homeowners view existing properties instead of building a home from the ground up, they run the risk of being dissatisfied or reluctant to follow through with the purchase. When asked, one in three said they’ve put in an offer only to change their minds completely on a home. The top reason for backing out? Bad news from a home inspection.

An additional one-third of people say they backed out simply because they changed their mind about the house itself. For more than half of buyers, the age of the home or the repairs needed are the biggest deal breakers; others include the size of the home (40%), neighborhood (37%), and school system (20%).

Methodology: Between February 28 and March 6, 2020, we surveyed 1,794 homeowners to learn about what they need most in a home. All respondents purchased a home within the last five years. Respondents were an average of 38 years old; 56% were female, 44% were male. A majority (63%) were married; 22% were single, 8% were engaged, 6% were divorced, and 1% were widowed.

For media inquiries, contact [email protected].

Fair Use

Feel free to use this data and research with proper attribution linking to this study. When you do, please give credit and link to https://lombardohomes.com/.